Engineering, Filling and Logistics Businesses

This segment includes manufacturing and sales of can and can end making machinery and beverage filling equipment, contract filling and sales of beverages, aerosol products and general liquid-filled products, and trucking and warehousing services.

Group companies in Engineering, Filling and Logistics businesses

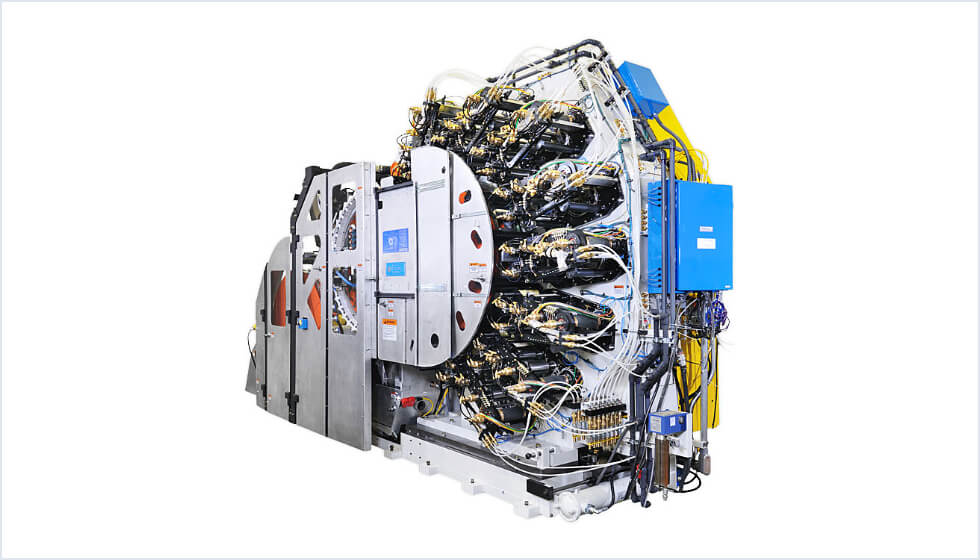

Engineering

Main operations: Manufacturing and sales of can and can-end production machinery and beverage filling equipment

-

Toyo Seikan Group Engineering Co., Ltd.

Manufactures and sells canning machinery, bottling machinery, packaging machinery and food processing machinery

-

Tokan Trading Corporation

Sells packaging materials, petrochemical products and food machinery, equipment & parts

-

Toyo Glass Machinery Co., Ltd.

Manufactures and sells molds for glass and plastic bottles, and glass bottle manufacturing machinery

-

Stolle Machinery Company, LLC

Develops, manufactures and sells can and end manufacturing machines and provides related services

-

Stolle Machinery do Brasil Industria e Comercio Equipamentos Ltda.

Manufactures and sells can and end manufacturing machines and provides related services

-

Stolle Asia Pacific Co., Ltd.

Sells can and end manufacturing machine parts and provides related services

-

STOLLE MACHINERY (SHANGHAI) CO., LTD.

Sells can and end manufacturing machine parts

-

Stolle Machinery (Guangdong) Co., Ltd.

Manufactures and sells can manufacturing machine parts

-

Stolle Europe Ltd.

Sells can and end manufacturing machines and provides related services

-

Stolle Machinery UK Ltd

Manufactures and sells can manufacturing machines and provides related services

-

Stolle EMS Precision Limited

Manufactures and sells can manufacturing machine parts

-

Stolle EMS Polska Sp. z o.o.

Manufactures and sells can manufacturing machines and provides related services

-

Kanagata (Thailand) Co., Ltd.

Manufactures and sells molds for plastic products

Filling

Main operations: Contract filling and sales of beverage products such as tea drinks, aerosol products such as insecticides and antiperspirant and deodorant sprays, and as well as general liquid-filled products, including such as shampoos and hand soaps

-

Toyo Aerosol Industry Co., Ltd.

Contract manufacturing and sales of aerosol and general filling products

-

TM Pack Co., Ltd.

Contract filling of PET-bottled beverage products

-

TOYO PACK KIYAMA Co., Ltd. *

Contract filling of beverage products

-

Toyo Seikan (Thailand) Co., Ltd.

Manufactures and sells general plastic products; manufactures and sells beverage PET bottles and provides contract filling; a technical support center and administration of group companies

-

Toyo Pack (Changshu) Co., Ltd.

Manufactures and sells beverage PET bottles and provides contract filling

-

Toyo Filling International Co., Ltd.

Contract manufacturing and sales of aerosol products

-

PREMIER CENTRE GROUP SDN. BHD.

Contract filling of home and personal care products

* Non-consolidated subsidiary

Logistics

This business includes trucking and warehousing services mainly for group companies.

-

Toyo Mebius Co., Ltd.

Trucking, warehousing and others

-

Tokan Logitech Co., Ltd.

Trucking and cargo handling operation contracting

-

Shin-Sankyo-Pd.

Trucking business

-

TOYO GLASS LOGISTICS CO., LTD.

Trucking business, various yard operation contracting

-

Toyo Mebius Logistics (Thailand) Co., Ltd.

Trucking business

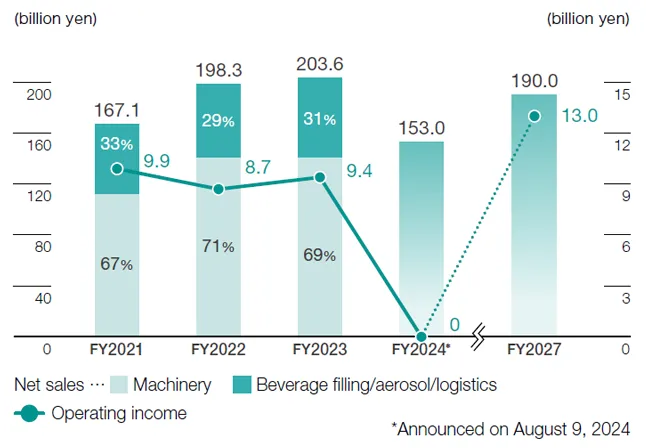

Results

The engineering, filling and logistics businesses recorded 203,671 million yen in net sales and 9,422 million yen in operating income, up 2.7% and 7.5% year on year, respectively.

SWOT Analysis

Competitive advantages

Engineering

- A technology development framework leveraging the comprehensive power of the Group’s expertise in materials, molding, machinery, analysis, and quality

- Supply capability, stable global customer base, and high market shares especially in Europe and the U.S.

Contract filling

Beverage products

- Trust in high-quality products both domestically and internationally

- Provision of comprehensive group services in Japan,including packaging, filling and logistics

- Overseas support for a wide range of contents, small to medium-sized production lots, and low-cost operations

Aerosol and general liquid-filled products

- High level of expertise developed as a leading company in the aerosols industry̶in technology, quality control, and development

- Production capabilities in pharmaceutical aerosols (equipment and technology)

Logistics

- Highly efficient transport utilizing facilities in product shipment

Issues

Engineering

- Build a revenue model unaffected by periodic demand trends

Contract filling

Beverage products

- Exploring growth opportunities that lead to the creation of Group synergies both domestically and internationally, and addressing the lack of production capacity for robust demand overseas

Aerosol and general liquid-filled products

- Recruitment and development of talent, visualize work better tailored to the individual worker

Logistics

- Securing personnel, including at partner companies, and addressing driver shortages

Risks

- Impact of country risk and geopolitical risk in connection with global expansion

- In the engineering business, periodic sluggishness in demand for plant and facilities

- In beverage filling, raw materials procurement risk subsequent to changes in the external environment and transition to in-house production at clients

- Talent outflow and difficulty in hiring new talent at partner companies as a result of the “2024 problem” in the logistics business

Opportunities

- In the engineering business, sustainable growth of aluminum can demand and prospects for major advances in market growth related to sustainability and recycling

- Diversification of preferences in beverage filling

- In aerosol and general liquid-filled products, expand the scale of the market by rolling out products in new fields

- Inflow of talent in connection with the building of a stable operation base in the logistics business

Strategy for continuous growth

Engineering

- Provide a comprehensive set of services, covering not only sales of plant and equipment, but also a comprehensive set of services including support for provisioning spare parts and upgrading plant and equipment

- Deploy capital effectively, with the main indicators designated as operating income, profits, and working capital; preserve the governance structure

- Partnerships for supplying products and technology

- Secure market share, protect technology, and establish a robust supply chain

Contract filling

Beverage products

- Develop facilities, marketing of packaging, and new technology revolving around the filling business

Aerosol and general liquid-filled products

- Review sales prices for improving profit margins, streamline production together with labor savings

Logistics

- Logistics that does not halt customers’ business activities

- Highly efficient transport utilizing domestic facilities

- Logistics that applies IT to reduce labor burdens

Progress and review of FY2023 in measures for continuous growth

1. Continuous growth in existing business domains

Engineering

- U.S. customers’ willingness to invest is fading due to rising interest rates, while a decrease in orders has resulted in lower earnings and profits. Thus, amid subdued growth estimates for FY2024 given the severe market conditions, we will focus on the securing of profits from the spare parts supply and support services business

Contract filling

Beverage products

- Expansion of the PET bottle aseptic filling line at Toyo Seikan(Thailand) Co., Ltd. (came online in December 2023) and the first PET bottle aseptic filling line for carbonated beverages to obtain approval by the US FDA

Aerosol and general liquid-filled products

- Revising sales prices for unprofitable products

Logistics

- Promote shorter lead times, streamline transport, and labor savings, revolving around the opening of the Toyo Mebius Kumagaya Logistics Center

2. Exploring, commercializing, and monetizing new growth opportunities

Engineering

- Expand compact can-making system and new aseptic filling system

Contract filling

Beverage products

- Explore opportunities for business expansion in the filling business, in Japan and overseas

Aerosol and general liquid-filled products

- Propose new uses for aerosol products (medical related, food and pet market, drone applications)

Logistics

- At the Toyo Mebius Kumagaya Logistics Center, deliver client cargo for received orders on return flights following product delivery, with a consequent reduction in environmental impact

3. Enhancing management foundation to support growth

Engineering

- Promote sustainability and corporate social responsibility (CSR)

Contract filling

Beverage products

- Promote work-style reforms, achieve labor savings from IoT and robotics, place personnel in growth fields, and contribute to reducing our environmental impact from products and the emergence of a low-carbon society

Aerosol and general liquid-filled products

- New technology development

- Academic collaboration programs

Logistics

- Create a comfortable workplace by promoting work-style reforms

4. Toward improvement in capital efficiency Engineering

Engineering

- Reduce costs by enhancing product in-sourcing, improve technical abilities and lead times

Contract filling

Beverage products

- Increase sales volume by increasing overseas production capacity through facility expansion

Aerosol and general liquid-filled products

- Capital efficiency review

Logistics business

- Drive streamlining of transport, capitalizing on each logistics facility starting with Toyo Mebius Kumagaya Logistics Center

Strategy and key measures in FY2024

Engineering

- In the short term, adjust business scale given expectations of a shrinking market, while addressing requirements in regions where demand for beverage canning facilities is expected to grow

- Raise profitability through productivity improvements and reducing costs

Contract filling

Beverage products

- Expand production capacity and raise profitability in Asia,where demand growth is expected, and study additional investment for business expansion

- Expand business domains from OEM production to ODM production starting with the development of beverage recipes in the domestic market

Aerosol and general liquid-filled products

- Sales price revisions of unprofitable products, study consolidation of production lines

- Convert Premier Centre Group Sdn. Bhd. into a subsidiary and pursue subsequent business synergies

Logistics

- Promote shorter lead times and greater efficiency by shifting to pallet transport and increasing the number of vehicles for in-house delivery