Capital Efficiency Initiative 2027

Capital Efficiency Initiative 2027

We launch a new initiative aiming to achieve an ROE of 8% or more for fiscal 2027, pursuing both our growth strategy and capital and financial strategy.

2025

Mid-term Management Plan2025

Action plan to address management issues and achieve Mid- to Long-Term Management Goals

[KPIs]

- ROE: 5.0%

- Net sales: 850 billion yen

Operating income: 50 billion yen - EBITDA: 110 billion yen

[Three key issues]

- Continuous growth in existing business domains

- Exploring, commercializing and monetizing new growth opportunities

- Enhancing management foundation to support growth

2027

Capital Efficiency

Initiative 2027

Measures to achieve business management that pays close attention to capital costs and the stock price

[KPIs]

- ROE: 8.0% or more

- Operating income:65 billion yen

- EBITDA:120 billion yen

- Profit (Net income):48 billion yen

- Equity capital:600 billion yen

- Share repurchase:100 billion yen

(Total for 5 years)

[Basic approaches]

-

Growth strategy

- Optimizing business portfolio

-

Capital and financial strategy

- Improving asset efficiency

2030

Mid- to Long-Term

Management Goals 2030

Quantitative/qualitative targets to realize our long-term management vision

[Economic value]

- Net sales: 1 trillion yen

- Operating income: 80 billion yen

[Social and environmental value]

- Contributing to environmental protection through the Eco Action Plan 2030

- Building a sustainable value chain

- Creating a workplace that allows diverse talent to grow and thrive

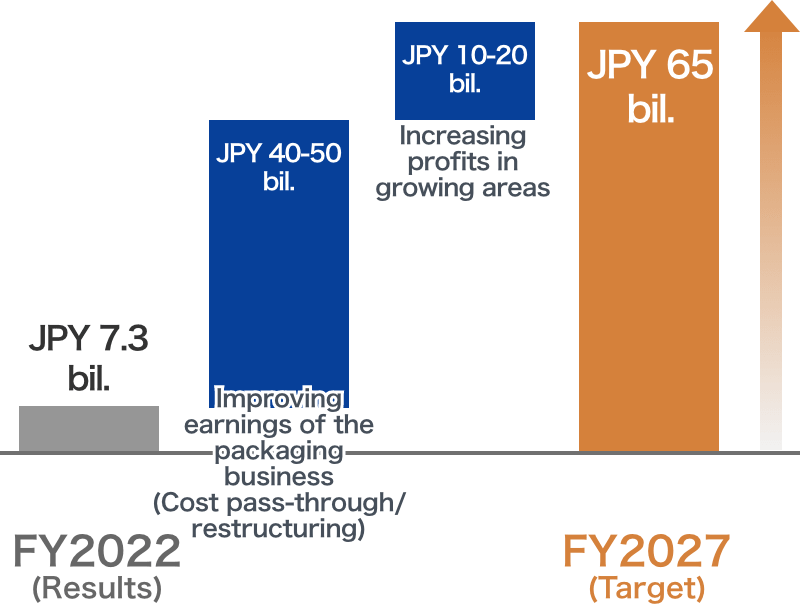

Measures to achieve an ROE of 8% or more

Aiming to achieve an ROE of 8% or more by increasing profits (R) and lowering equity capital (E).

Increase in R: Operating income

(FY2023–FY2027)

Aim for operating income of 65 billion yen

by optimizing business portfolio

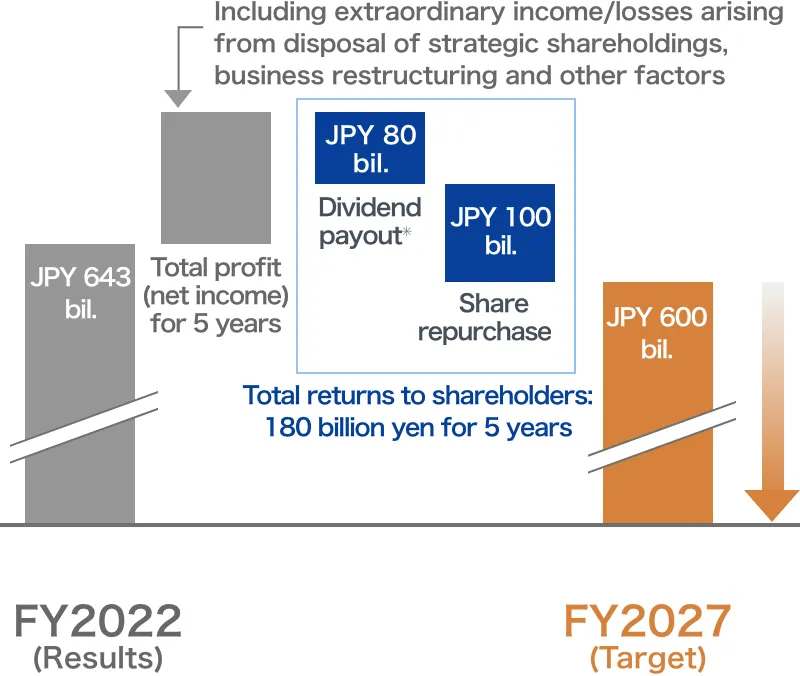

Decrease in E: Equity capital

(FY2023–FY2027)

Aim to reduce equity capital to 600 billion yen

by enhancing shareholder returns

- The dividends for FY2026 and FY2027 are assumptions based on the planned level for FY2025, and the dividend plans for the years will be determined based on actual earnings.

Growth strategy

Optimizing business portfolio

- Allocate more resources to growth areas of the engineering/filling/logistics, steel plate related, and functional materials related businesses.

- Seek appropriate cost pass-through and streamline and restructure unprofitable operations mainly in the domestic packaging business.

- The table can be scrolled left or right.

| (in billions of yen) | FY2022 results | FY2023–FY2025 | FY2026–FY2027 | FY2027 targets |

|---|---|---|---|---|

| Packaging Restructuring |

Net sales: 544.4 Operating income: -10.7 Operating income margin: -2.0% |

Cost pass-through efforts

(30 to 35 billion yen) |

Net sales: 600.0 Operating income: 30.0 (+40.7) Operating income margin: 5.0% |

|

|

Restructure unprofitable operations.

|

||||

|

Reduce environmental impact. / Promote automation, labor saving and other cost cutting efforts.

|

||||

| Engineering/Filling/Logistics Growth(and restructuring) |

Net sales: 198.3 Op. income: 8.7 Op. margin: 4.4% |

Restructure unprofitable operations.

|

Net sales: 190.0 Op. income: 13.0 (+4.3) Op. margin: 6.8% |

|

|

Improve profitability by tapping into the growing global market for can making machines. (Engineering) /

Increase production capacity in Asian markets with high growth potential. (Filling) |

||||

| Steel Plate Growth |

Net sales: 86.5 Op. income: 4.6 Op. margin: 5.4% |

Invest in production of materials and components for automotive rechargeable batteries, which are rapidly growing.

|

Net sales: 110.0 Op. income: 7.0 (+2.4) Op. margin: 6.4% |

|

| Functional Materials Growth |

Net sales: 45.7 Op. income: 2.0 Op. margin: 4.4% |

Pursue growth through the expansion of business areas by leveraging our technologies in optical and other functional films.

|

Net sales: 60.0 Op. income: 6.0 (+4.0) Op. margin: 10.0% |

|

| Cross-segment growth areas Growth |

Continue to expand components and engineering operations in the mobility market.

|

Net sales: 80.0 Op. income: 6.0 (+6.0) |

||

|

Expand filling and packaging manufacturing operations through M&As in growing overseas markets, particularly in South East Asia.

|

||||

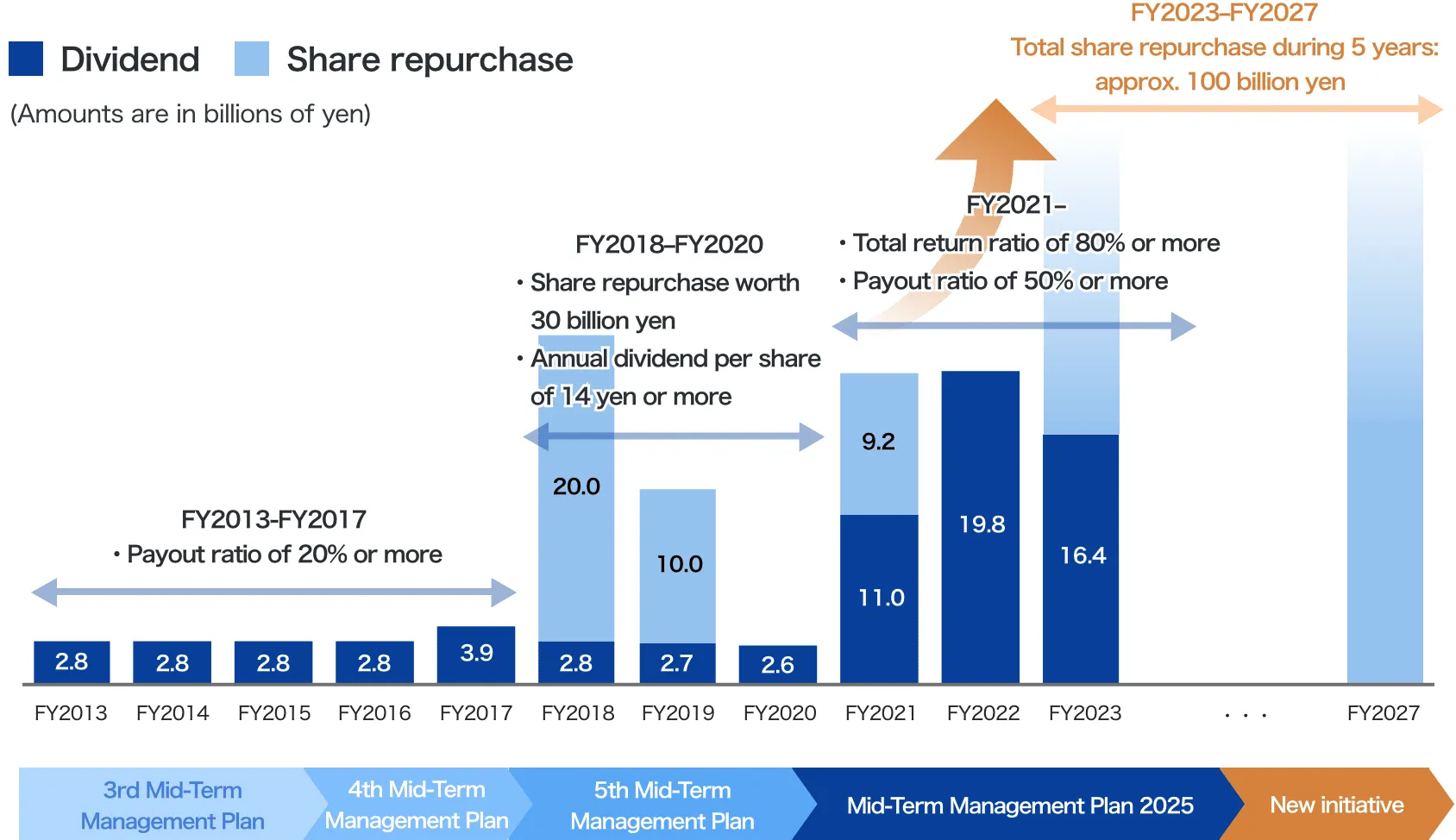

Capital & financial strategy

Improving asset efficiency

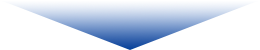

- Substantially increase returns to shareholders through dividend payment and share buybacks, which we have gradually enhanced.

- Further reduce “strategic shareholdings” (incl. cross-shareholdings).

- Reduce assets in unprofitable operations and streamline real estate management (disposal and adding value).

- The table can be scrolled left or right.

Cash allocation (FY2023 - FY2027)

Seeking business growth and higher returns on capital, we will strategically allocate funds obtained from operating cash flows and through asset disposal and fundraising to investment activities and shareholder returns.

- The table can be scrolled left or right.

- The dividends for FY2026 and FY2027 are assumptions based on the planned level for FY2025, and the dividend plans for the years will be determined based on actual earnings.

Financial targets

New targets for profit and equity capital for fiscal 2027 to further improve capital efficiency

- The table can be scrolled left or right.

| New initiative | |||||

|---|---|---|---|---|---|

| FY2022 (Results) | FY2025 | FY2027 | FY2030 | ||

| Earnings(billion yen) | Net sales | 906.0 | 850*1 | - [1,050] (For reference) |

1,000*1 |

| Operating income | 7.3 | 50 | 65 | 80 | |

| EBITDA | 60.3 | 110 | 120 | - | |

| EBITDA | 10.3 | 35 | 48 | ||

| Returns on capital(billion yen) | ROE | 1.6% | 5.0% | 8.0% and more | |

| Equity capital (Additional target) |

643.0 | - | 600 | ||

| FY2022 (Results) | FY2021-2025 | FY2023-2027 | |||

| Returns to share-holders | Consolidated payout ratio (%) (Dividend per share) |

156% (89 yen) |

Target 50% or more (Minimum 46 yen, to be gradually increased) |

Same as left Total payout for 5 years: 80 billion yen*2 |

|

| Total return ratio (%) (Share repurchase) |

156% (-) |

Target 80% or more (9.2 billion yen worth already repurchased) |

Total repurchase for 5 years: 100 billion yen | ||

- The sales targets for FY2025 and FY2030 have remained unchanged since the current sales growth reflects the impact of currency fluctuations and efforts to pass on higher energy costs to customers, among other factors.

- The dividends for FY2026 and FY2027 are assumptions based on the planned level for FY2025, and the dividend plans for the years will be determined based on actual earnings.