Packaging Business

Leading packaging manufacturer

In this segment, we manufacture and sell packaging containers that are essential for our daily life, including food and beverage cans, plastic bottles and pouches, caps, paper containers, and glass bottles.

We can offer a variety of containers with a diversified product line-up across the group to flexibly respond to the needs of customers and society.

Group Companies in the Packaging business

Metal products - Beverage cans

Main operations: Manufacturing and sales of metal cans for soft drinks such as ready-to-drink coffee and carbonated drinks, and alcoholic beverage, including beer and Chuhai cocktails

-

Toyo Seikan Co., Ltd.

Manufactures and sells various kinds of cans and containers and filling equipment

-

Honshu Seikan Co., Ltd.

Manufactures and sells 18 liter cans, metal cans and general line cans

-

Nippon National Seikan Co., Ltd.

Manufactures and sells beverage cans

-

Ryukyu Seikan Kaisha, Ltd.

Manufactures and sells PET bottles and sells various packaging containers

-

Bangkok Can Manufacturing Co., Ltd.

Manufactures and sells 2-piece aluminum cans and aluminum ends

-

Next Can Innovation Co., Ltd.

Manufactures and sells 2-piece steel & aluminum cans

-

Asia Packaging Industries (Vietnam) Co., Ltd.*

Manufactures and sells 2-piece aluminum cans and ends

* Affiliate accounted for under the equity method

Metal products - Cans for food and household products

Main operations: Manufacturing and sales of cans for seafood, fruit and other food products as well as cans for household products such as insecticides and bath agents

-

Toyo Seikan Co., Ltd.

Manufactures and sells various kinds of cans and containers and filling equipment

-

Honshu Seikan Co., Ltd.

Manufactures and sells 18 liter cans, metal cans and general line cans

-

Ryukyu Seikan Kaisha, Ltd.

Manufactures and sells PET bottles and sells metal cans

-

Bangkok Can Manufacturing Co., Ltd.

Manufactures and sells 2-piece aluminum cans, welded cans and aluminum ends

Metal products - Metal caps

Main operations: Manufacturing and sales of Maxi caps and crown caps for soft drinks and alcoholic beverage as well as screw caps for food products

-

Nippon Closures Co., Ltd.

Manufactures and sells metal and plastic closures

-

Riguan Closure (Changshu) Co., Ltd.

Sells metal and plastic closures

-

NCC Europe GmbH

Sells metal closures

-

Crown Seal Public Co., Ltd.*

Manufactures and sells metal and plastic closures and crown closures

* Affiliate accounted for under the equity method

Metal products - Other metal products

Main operations: Manufacturing and sales of diversified metal products, including 18-liter cans

-

Honshu Seikan Co., Ltd.

Manufactures and sells 18 liter cans, metal cans and general line cans

-

Ryukyu Seikan Kaisha, Ltd.

Manufactures and sells PET bottles and sells metal cans

-

Toyo Seihan Co., Ltd.

Manufactures and sells printing plates for printing metal and film

-

Fukuoka Packing Co., Ltd.

Manufactures and sells sealant for metal, plastic and glass containers

-

T&T Enertechno Co., Ltd.

Manufactures and sells packaging material mainly for lithium-ion secondary batteries

-

Global Eco-can Stock (Thailand) Co., Ltd.

Manufactures and sells resin-coated aluminum materials

Plastic products - PET bottles for beverage

Main operations: Manufacturing and sales of PET bottles for soft drinks such as carbonated drinks and tea beverage, and for alcoholic beverage, including sake and shochu

-

Toyo Seikan Co., Ltd.

Manufactures and sells various kinds of cans and containers and filling equipment

-

Ryukyu Seikan Kaisha, Ltd.

Manufactures and sells PET bottles and sells metal cans

-

Toyo Seikan (Thailand) Co., Ltd.

Manufactures and sells general plastic products; manufactures and sells beverage PET bottles and provides contract filling; a technical support center and administration of group companies

-

Tokan (Changshu) High Technology Containers Co., Ltd.

Manufactures and sells plastic products

Plastic products - Plastic bottles

Main operations: Manufacturing and sales of plastic bottles for food products such as mayonnaise and salad dressing and for household products, including laundry detergents and shampoos

-

Mebius Packaging Co., Ltd.

Manufacturing and sales of plastic products

-

Toyo Seikan (Thailand) Co., Ltd.

Manufactures and sells general plastic products; manufactures and sells beverage PET bottles and provides contract filling; a technical support center and administration of group companies

-

Tokan (Changshu) High Technology Containers Co., Ltd.

Manufactures and sells plastic products

Plastic products - Plastic films, pouches and trays

Main operations: Manufacturing and sales of plastic pouches for ready-to-eat curry and other food products and refill pouches for laundry detergents and other household products

-

Toyo Seikan Co., Ltd.

Manufactures and sells various kinds of cans and containers and filling equipment

-

Tokan Kogyo Co., Ltd.

Manufactures and sells paper and plastic packaging container products

-

Tokan (Changshu) High Technology Containers Co., Ltd.

Manufactures and sells plastic products

Plastic products - Plastic caps

Main operations: Manufacturing and sales of plastic caps mainly for beverage PET bottles

-

Nippon Closures Co., Ltd.

Manufactures and sells metal and plastic closures

-

Mebius Packaging Co., Ltd.

Manufacturing and sales of plastic products

-

Riguan Closure (Changshu) Co., Ltd.

Sells metal and plastic closures

-

Crown Seal Public Co., Ltd.*

Manufactures and sells metal and plastic closures and crown closures

* Affiliate accounted for under the equity method

Plastic products - Other plastic products

Main operations: Manufacturing and sales of plastic cups, BIBs (bag-in-boxes) and various other plastic products

-

Toyo Seihan Co., Ltd.

Manufactures and sells printing plates for printing metal and film

-

Japan Bottled Water Co., Ltd.

Manufactures and sells bottled water related materials for delivery service

-

Tokan Kogyo Co., Ltd.

Manufactures and sells paper and plastic packaging container products

-

T&T Enertechno Co., Ltd.*

Manufactures and sells packaging material mainly for lithium-ion secondary batteries

-

TAIYO PLASTIC CORPORATION OF THE PHILIPPINES

Manufactures and sells plastic products

* Affiliate accounted for under the equity method

Paper products

Main operations: Manufacturing and sales of paper containers, including paper cups for beverage and food products, and various types of corrugated cardboard products

-

Tokan Kogyo Co., Ltd.

Manufactures and sells paper and plastic packaging container products

-

Nippon Tokan Package Co., Ltd.

Manufactures and sells cardboard products and printed paper container products

-

Tokan Takayama Co., Ltd.

Manufactures and sells paper packaging container products and lid products

-

Sunnap Co., Ltd.

Plans and sells paper and plastic dishwares

-

Shosando Co., Ltd.

Manufactures and sells paperwares

Glass products

Main operations: Manufacturing and sales of glass bottles for soft drinks and alcoholic beverage and various types of glass tableware for restaurants and households

-

TOYO GLASS CO., LTD.

Manufactures and sells glass bottles

-

TOYO - SASAKI GLASS CO., LTD.

Manufactures and sells glassware

-

TOHOKU KEISYA CO., LTD.

Manufactures and sells silica sand

-

TOSHO GLASS CO., LTD.

Sells glass products

-

ICHINOSE-TRADING CO., LTD.

Sells glass bottles and accessories

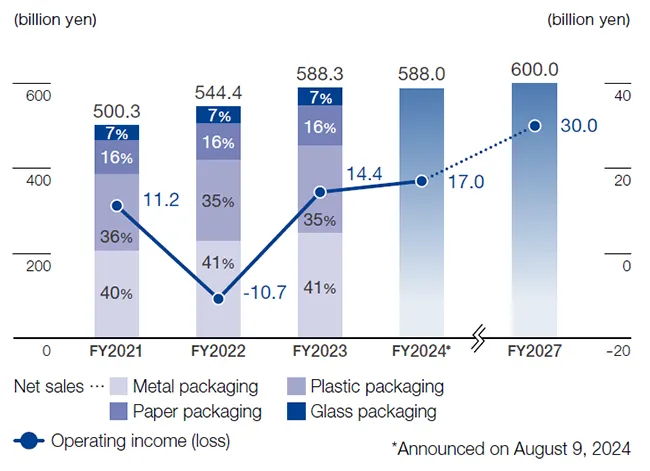

Results

The packaging business recorded 588,352 million yen in net sales, up 8.1% year on year, and 14,460 million yen in operating income, compared to operating loss of 10,765 million yen for the previous year.

Share/SWOT Analysis

Share in Japan(Source: our research)

-

Metal cans

Top

in the industry

Approx.40%

-

PET bottles

(including preforms)Top

in the industry

Approx.30%

-

Plastic caps for beverage

(including preforms)Top

in the industry

Approx.60%

-

Food/beverage

paper cupsTop

in the industry

Approx.60%

-

Glass bottles

2nd

in the industry

Approx.30%

Competitive advantages

- Superior product development capability and quality

- Products with price competitiveness supported by the capability of stable supply

- A sense of trust with a robust customer base cultivated over the long term

Issues

- Building a profit framework unaffected by the external environment, including raw material and energy prices,foreign exchange rates

- Optimizing the sales strategy and production system based on demand trends

- Securing talent, improving employee engagement and fermenting a corporate culture that can tackle new challenges

Risks

- Surging raw material and energy costs

- Intensifying market competition

- Difficulties in hiring talent as a result of the shrinking workforce

Opportunities

- Higher demand for aluminum products to reduce environmental impact

- Entry into new fields and establishment of production technology as a result of changes in market preferences and demand

- Productivity improvements through advances in digitalization

Strategy for continuous growth

- Optimize the production system and products through investment and development in growth fields

- Apply appropriate cost pass-throughs and maintain profit margins through cost controls in response to fluctuation in raw material and energy costs and foreign exchange rates

Metal products

- Ensure development and investment results from the Fifth Mid-Term Management Plan

- Expand sales and enhance capabilities for markets with expected demand growth

- Reduce the environmental impact from products, processes,and materials

- Undertake product development directed at creating value added

Plastic products

- Extend sales of caps for PET beverage bottles where demand is projected to grow and of products for retort pouches

- Invest in adding production capacity for products with high expected growth resulting from the restructuring of production items in common plastic bottles

- Improve profitability through reduction of fixed and indirect manufacturing costs

Paper products

- Enhance use of manufacturing equipment

- Improve production efficiency from higher speed plant and equipment and changing the set of production items

Glass products

- Continue development and extend sales of high-value-added products

- Reduce costs through energy conservation, labor-saving measures, production efficiencies, and work-style reforms (including use of DX)

- Take action to establish an optical lens business and reduce GHG emissions

Progress and review of FY2023 in measures for continuous growth

- Implement cost pass-throughs and cost savings in response to the sudden rise of raw material and energy costs

- Shift management resources toward growth opportunities

- Examine rebuilding of unprofitable business domains and facilities

- Drive development and release of products that are environmentally sound

1. Continuous growth in existing business domains

- Establish technology for horizontal recycling of aluminum as a result of entering into mass production of lightest weight aluminum cans and development of EcoEnd™ aluminum beverage can lids

- Make investments in savings on personnel and labor-saving equipment on manufacturing lines (introduce robots, etc.)

- Improve production efficiency based on restructuring of production items, and reduce costs

- Develop and extend sales of high-value-added products (including alcohol bottles for overseas export, semiconductoruse containers)

2. Exploring, commercializing, and monetizing new growth opportunities

- Set up new product manufacturing line for paper packagings,where usage is expected to grow

- Achieve the business plan in the optical lens business

- Search for use cases and development of water-soluble glass(blue carbon ecosystems, etc.)

- Drive market development using special-use packaging systems and packaging forms for e-commerce logistics

3. Enhancing management foundation to support growth

- Raise productivity through work-style reform, applications of IoT & DX, and organizational reform, while placing personnel in growth fields

- Develop technology for reducing environmental impact of products

- Restructure the development framework for cultivating new markets, introduce production facilities

4. Toward improvement in capital efficiency

- Organize and reduce asset holdings

- Improve earnings based on extended sales and cost passthroughs of high-value-added products

- Reduce costs through improved yields

Strategy and key measures in FY2024

- Drive cost pass-throughs, not only of surging raw material and energy costs, but also personnel and logistics costs

- Drive the shift of management resources toward growth opportunities

- Reduce costs through labor savings

- Development and marketing of products that are environmentally sound

- Continue activities toward rebuilding of unprofitable business domains and facilities

Metal products

- Revise sales prices to secure appropriate profit levels

- Drive further development of the lightest weight aluminum can and horizontal recycling of aluminum

- Lithium-ion in Sweden: erecting a supply system for external packaging of rechargeable batteries

Plastic products

- Add production capacity of preforms for sales where demand is expected to grow

- Invest in restructuring of production items in common plastic bottles and added production capacity for products with high expected growth

- Improve capital efficiency through reduction of fixed and indirect manufacturing costs

Paper products

- Develop molding machines for paper lids and high-speed molding machines for paper cups

- Improve logistics efficiency by promoting use of pallets and automating cargo handling

- Reduce costs through yield improvements, development of labor-saving equipment, and reduction of material use

Glass products

- Develop and extend sales of high-value-added products

- Drive mechanization of production processes and introduction of robots

- Carry out R&D of oxygen hydrogen combustion technology for glass furnace