Message from the Officer in Charge of Finance

FY2023 and FY2024 Business Performance

The pass-through of higher raw material and energy costs resulted in a 4.9% increase in sales and a 357.6% increase in operating income

Regarding business performance during FY2023, the Toyo Seikan Group achieved revenue and profit increases consisting of net sales of 950.6 billion yen (up 4.9% year on year) and operating income of 33.8 billion yen (up 357.6% year on year). Ordinary income was 38.7 billion yen (up 181.3% year on year) due to the recording of foreign exchange gains and despite a decrease in investment profits in entities from equity-method affiliates. Profit attributable to owners of parent was 23.0 billion yen (up 122.7% year on year) and included the taking of impairment losses. The main factors behind the increase in net sales include progress on the cost pass-through of the sudden cost increases in raw material and energy prices mainly in the domestic packaging business as well as the drastic depreciation of the yen. The substantial increase in operating income reflects cost passthroughs and cost savings initiatives related to the rising raw

material and energy prices.

In cost pass-throughs, we grappled with the pronounced surge in raw material and energy prices from three years ago and were able to pass through 96% of the

increased costs that occurred during the three-year period ending in FY2023.

As for the Group’s business performance* in FY2024, we anticipate an increase in sales volume due to the recovery trend in the market for aluminum substrates for magnetic disks in the functional materials related business. However, we expect the market conditions to continue to deteriorate in the North American engineering business. Therefore, we project a decrease in net sales of 920 billion yen (a 3.2% decrease compared to the previous year), a decrease in operating profit of 30 billion yen (an 11.4% decrease), a decrease in ordinary profit of 30 billion yen (a 14.8% decrease), and an increase in net income attributable to the parent company shareholders of 240 billion yen (a 4.0% increase).

- Net sales, operating income, ordinary income, and profit attributable to owners of parent are based on the figures announced on November 8, 2024.

Progress on Capital Efficiency Initiative 2027 Growth Strategy

Steady growth in automotive rechargeable battery materials and for solar batteries as products that bear the new era

Under Capital Efficiency Initiative 2027 announced in May 2023, which runs atop the twin axes of “growth strategy” and “capital and financial strategy,” we have set out a basic policy of improving capital efficiency through a variety of innovations and reformations.

One result of the growth strategy in the initial year of 2023 include, appeared in the steel plate related business, where the tailwind propelled by expanded adoption of electric vehicles and hybrids contributed to profits through solid growth in sales for automotive rechargeable battery materials (nickelplated steel sheet), manufactured by Toyo Kohan Co., Ltd. Also, in the functional materials related business, development is proceeding on barrier films that leverage the moisture barrier technology held by the Company. In 2024, we expect to place the product on the market as a protective film for solar power generation. These automotive rechargeable battery materials and barrier films are promising areas for significant future growth.

“Optimizing business portfolio” is one of the major policies laid out. In accordance with this policy and in light of changes in the external environment, the Company is

scrutinizing profitability at each business and is implementing a shift in management resources away from low profitability businesses and toward high profitability ones.

Following the drafting of Mid-Term Management Plan 2025 and Capital Efficiency Initiative 2027, we set ROE targets and have made it a rule not to make investments that do not contribute to meeting this target. Based on this clearly stated target, we are on the one hand ensuring that investments in the packaging business are performed. On the other hand, we will aggressively direct our management resources toward the engineering, filling and logistics businesses, as well as the steel plate related business and the functional materials related business̶the three businesses we have positioned as growth areas. In this way, I believe we can restructure our business portfolio befitting these standards while clearing the path to the future.

Looking ahead, the policy will be one of effectively leveraging M&A through a multifaceted strategy, in which business buyouts are conducted in order to take a leap forward in growing areas and businesses are sold off with the aim of putting unprofitable operations in order.

Capital and Financial Strategy in Capital Efficiency Initiative 2027

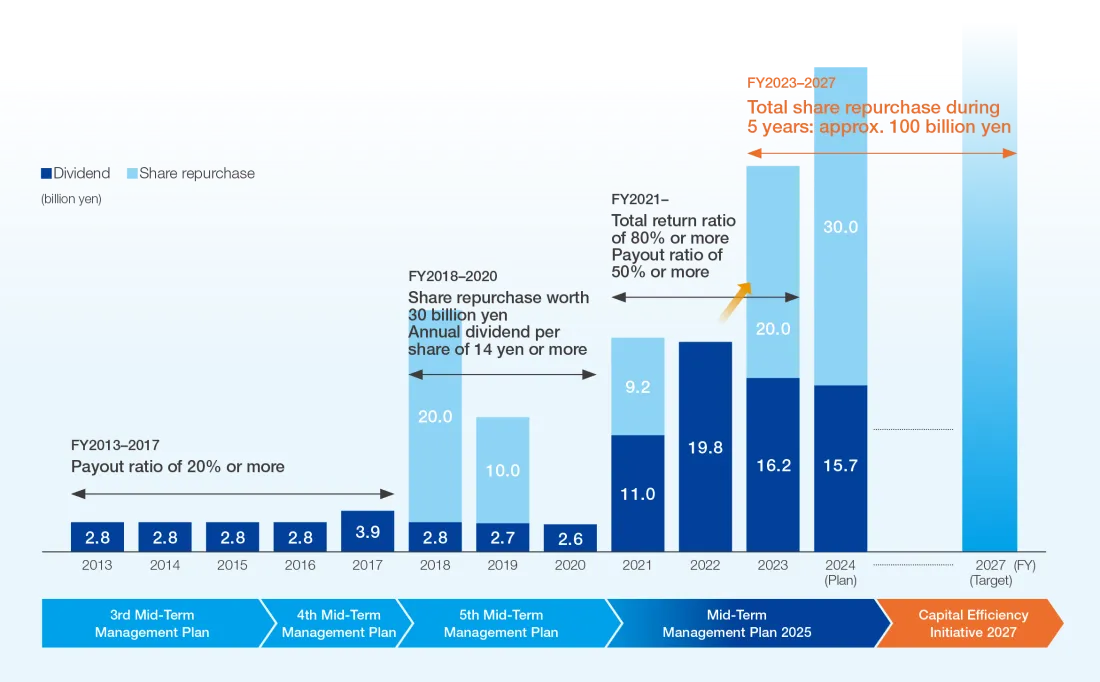

Repurchased 20 billion yen worth of shares in FY2023 Planning for 30 billion yen in FY2024 through an increase in net assets

In the Capital Efficiency Initiative 2027, particular emphasis is placed on "improving asset efficiency." To realize this strategy, we have made a significant enhancement in shareholder returns

through dividends and share repurchases. In FY2023, we repurchased 20 billion yen of our own shares, as planned, and paid out an interim dividend of 90 yen per share (for a total of 16.2 billion yen in dividends). However, because net assets increased due to larger-than-forecast yen depreciation and higher stock prices, we increased our share repurchases by 10 billion yen for FY2024, from the initial plan of 20 billion yen to 30 billion yen. This flexible response to changes speaks to our intent to make steady progress on achieving our plan. It does not change our initial plans to repurchase a cumulative total of 100 billion yen in shares by FY2027.

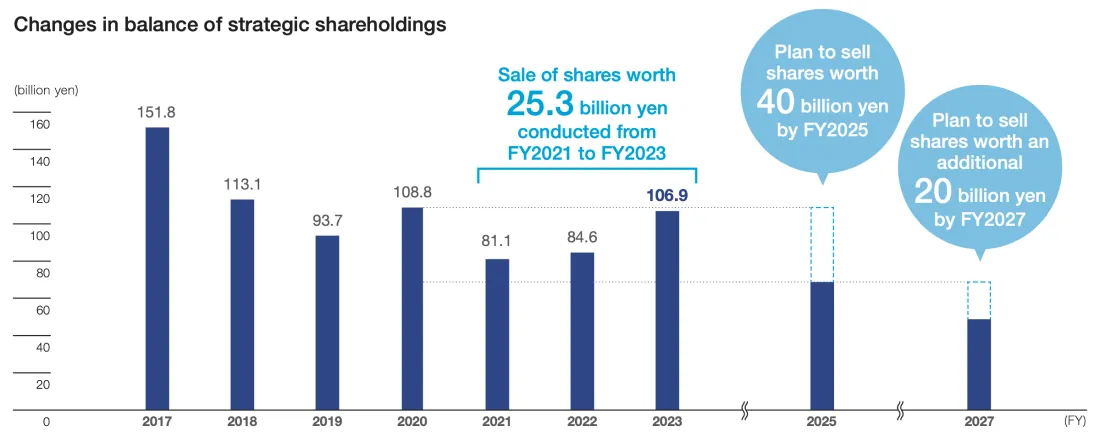

Regarding the reduction of strategic shareholdings, we have set 40 billion yen for this purpose in Mid-Term Management Plan 2025 together with an additional 20 billion yen in Capital Efficiency Initiative 2027, for a planned total execution of 60 billion yen in sales. Given the steady progress on our plan, the remaining amount for sales is roughly 35 billion yen. In consideration of rising stock prices, we are envisioning a rise to roughly 40 billion yen on these sales, and are keeping an eye on trends in the stock market.

- The table can be scrolled left or right.

Cash Allocation in Capital Efficiency Initiative 2027

Raising funds without depending on interest-bearing debt and promoting growth investment at each business

In Capital Efficiency Initiative 2027, the Toyo Seikan Group has clearly stated that the pillar of our cash allocation is to strategically allocate the sources of funding̶operating cash flows, asset disposals, and fund procurement̶between investment and shareholder returns.

Specifically, we are projecting cash inflows during

FY2023–2027 of 370 billion yen in operating cash flows and approximately 80 billion yen in asset disposals and fund procurement. The plan allocates this cash as 270 billion yen to investment and 180 billion yen to shareholder returns.

Our investments and new development projects up to FY2023 in the packaging business have made progress on the advance toward products that are environmentally sound including development of EcoEnd™ and the entering into mass production of the lightest weight domestic aluminum cans. In the engineering, filling and logistics businesses, we have added a new beverage filling line in Thailand, which started operations in December 2023.

In the steel plate related business, we have focused on plant and equipment related to automotive rechargeable batteries with new and expanded manufacturing facilities coming online in November 2023 and January 2024, respectively.

In FY2024 and later, we will expand the filling business and packaging business centered on Southeast Asia and devote management resources to expanding businesses that are already on a growth trajectory, including automotive rechargeable batteries. Together with this, we will undertake an aggressive set of initiatives in capital investment and M&A in future growth areas. Furthermore, investment in FY2024 is projected to total 60 billion yen including the acquisition of PCG shares in Malaysia according to an agreement signed in February 2024.

To Our Stakeholders

After being announced in May 2023, Capital Efficiency Initiative 2027 appears to be having a major impact both within and outside the Company as a bold expression of the Group’s intent and is receiving a generally favorable evaluation.

Within the Company, the mutual sense of crisis felt like something big. Up to now, the Group has had a tendency to emphasize net sales, sales volumes, and industry share. But I have always urged at various internal meetings that we should emphasize profit not sales because without profit, the Company could not continue to exist. This attitude is beginning to spread throughout the entire Company.

Looking ahead, it is my hope that we will communicate more closely with stakeholders, and that energizing communications within the Group and further refining initiatives for improving corporate value will contribute to the sustainable growth of the Toyo Seikan Group.