Mid-term Management Plan

Mid-Term Management Plan 2025

As an action plan to achieve the Mid- to Long-Term Management Goals 2030, we have formulated the Mid-Term Management Plan 2025 (the “Plan”) for the five years from fiscal 2021.

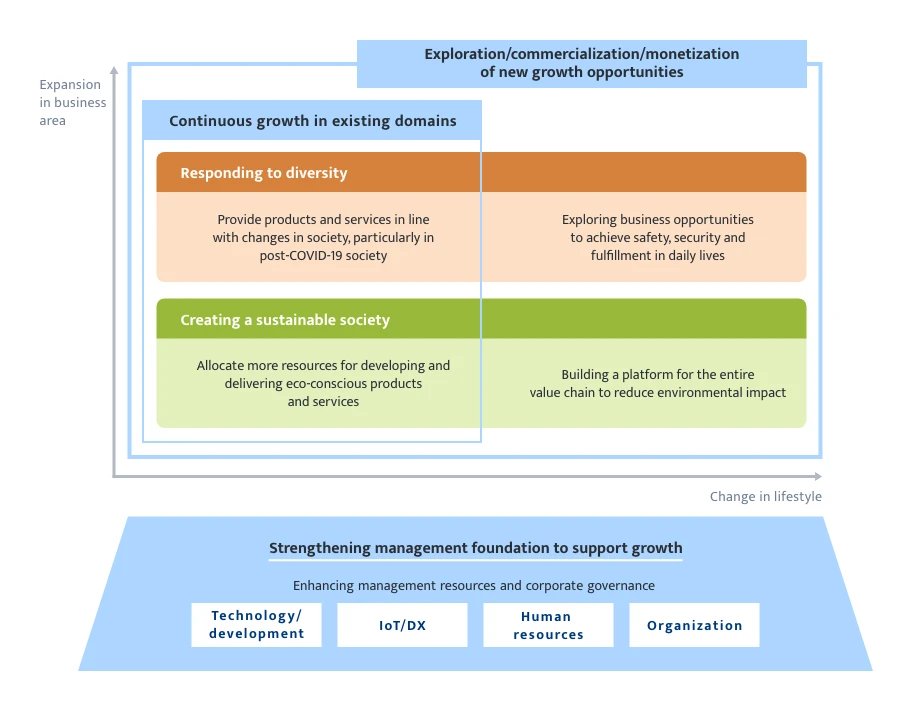

Fundamental policy of the plan

Under the Plan, we will pursue a continuous growth toward the "daily living platform" by working on three key issues to create a society we envision in the Long-Term Management Vision 2050.

Three key issues and measures

- Seeking cotinuous growth in existing business domains

- Exploring, commercializing and monetizing new growth opportunities

- Enhancing management foundation to support growth

1) Continuous growth in existing business areas

We will aim to achieve continuous growth in our existing domains by drastically changing our business portfolio, without being bound by our traditional business structure, based on the two pillars of our long-term vision, "responding to diversity" and "creating a sustainable society," and from the perspective of continuous development.

Expanding our existing fields by allocating more facilities

and human resources to growth areas

- The table can be scrolled left or right.

Responding to Diversity

Provide products and services in line with changes in society, particularly in post-COVID-19 society

Creating a Sustainable Society

Allocate more resources for developing and delivering eco-conscious products and services

Various lifestyles

- Products to offer fun and convenience in cooking

(Pouches, paper containers for delivery, cans for food) - Products to create a moment of relaxation

(Aluminum cans and glass products for drinking at home/components for mobile and TV displays)

Supporting a clean and comfortable life

- products for e-commerce

- Anti-virus agent and hygiene products (Pouches/ Sanitizer packaging)

Reducing environmental impact and information disclosure

- Lightweighting, more use of biomass materials

- Fewer resources and less energy in production

- Disclosure of Life Cycle Assessment data

Contributing to a zero-carbon society

- Materials for automotive batteries

Solutions for plastic-free movement

- Tapping into a globally growing need for canmaking lines

2) Exploring, commercializing and monetizing new growth opportunities

In response to diversifying needs and emerging issues in the society, such as changes in lifestyles and efforts to reduce environmental impact, we will offer a new social infrastructure by creating new businesses in the areas of "food and health," "comfortable living" and "environment, resources and energy," based on the technologies we have accumulated in material development, package processing and engineering.

Offering a new social infrastructure by creating new businesses in the areas of "food and health," "comfortable living" and "environment, resources and energy"

- The table can be scrolled left or right.

Responding to Diversity |

Creating a Sustainable Society |

|

Business areas |

[Food and health] [Comfortable living] |

[ Environment/resources/energy] |

Social issues |

|

|

Create and implement new schemes to solve social issues |

||

Measures |

|

|

Examples of products/ services |

Exploring business opportunities to achieve safety, security and fulfillment in daily lives

|

Building a platform for the entire value chain to reduce environmental impact

|

3) Enhancing management foundation to support growth

We will enhance our management resources and strengthen our corporate governance to achieve a continuous growth.

We will enhance our management resources and strengthen our corporate governance to achieve a continuous growth.

Technology / Development

Promote R&D activities to create new businesses through cooperation with partners and exploration of new technologies

- Seeking Partnerships with customers and suppliers

- Joint research with universities and research institutes

- Open innovation with start-ups

Internet of things / Digital transformation

Make use of digital technology to transform the value chain and expand business domains

- Smart factories that realize autonomous production and a more efficient operational process / workplace transformation

- Data sharing across the supply chain

- Application of loT and DX technologies to expand business areas

Human resources

Develop a human resources platform that leads to new value creation

- Creation of a corporate culture that allows employees to demonstrate their unique abilities regardless of nationality, race, gender, disability, career or other attributes

- Best allocation and fostering of talents that can compete and take on challenges globally

- Realization of a flexible work style suited for every life stage

Organization

Enhance corporate governance to earn the trust of society

- Establishment of an efficient corporate management system to prepare for future changes in business structure

- Enhancement of systems to send out and disclose information

- Consideration of introducing a performance-linked compensation scheme

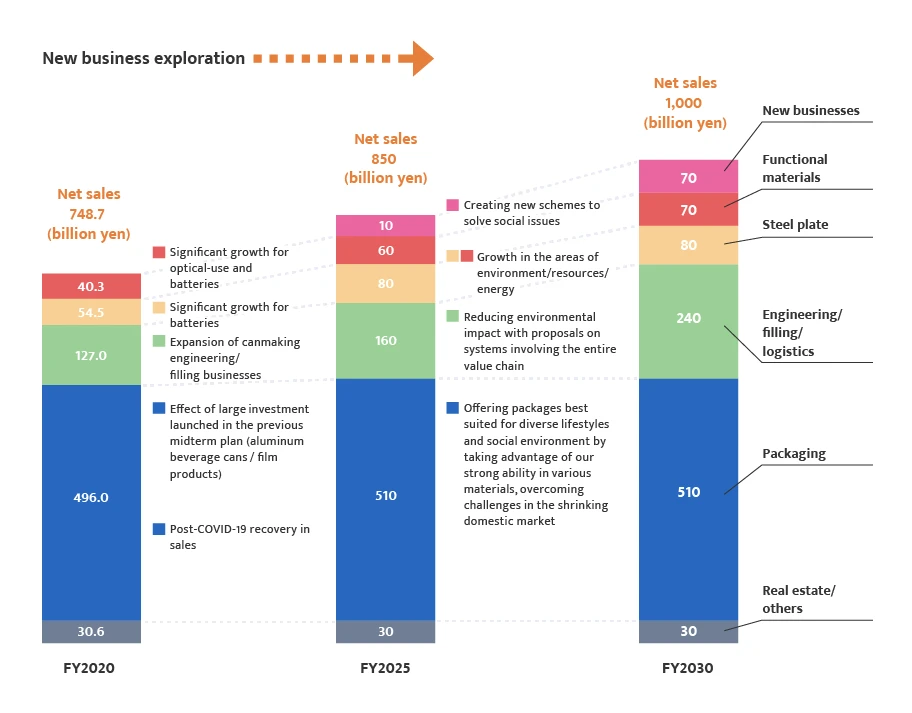

Road map for continuous growth

Based on our packaging business, we will expand our value chain in the areas of engineering, filling and logistics while seeking growth of optical-use and battery materials in our steel plate-related and functional material-related operations. In new business fields, we will also create new schemes to solve social issues. With these strategies in place, we aim for net sales of one trillion yen for fiscal 2030.

Investment and financial policy

We will use the cash generated from business operations and asset reduction initiatives to fund investment in future growth and platform enhancement.

Investing in future growth and platform enhancement with the cash generated from business operations and asset reduction initiatives

Investment

Expecting a total 330 billion yen of investment (including M&A) toward the "daily living platform"

- Investment to reduce environmental impact and increase environmental value

- Developing a system for the entire value chain, beyond the traditional framework of packaging manufacturing

- Enhancing foundation for existing core business areas

- Seeking activities to create and grow new businesses, including cooperation with business partners and start-ups, focusing on the areas of "food and health," "comfortable living" and "environment, resources and energy"

- Advancing loT and DX initiatives, developing new technologies and human resources, etc.

Capital

Approx. 380 billion yen in operating cash flow that we expect to generate during the period of the Mid-Term Management Plan.

Approx. 40 billion yen in proceeds from the sale of so-called strategic shareholdings. The proceeds will be invested in growth areas.

Planned investment by category

| Purposes | Expected Amount (billion yen) |

Reference | |

|---|---|---|---|

| Exploring, commercializing and monetizing new growth opportunities |

Main purposes of investment

|

160 | |

| Seeking continuous growth in existing business domains |

Enhancing foundation for existing core business areas |

150 | Seek to realize more laborsaving facilities with lower environmental impact at the time of equipment renewal |

| Enhancing management foundation |

Advancing loT and DX initiatives, developing new technologies and human resources, etc. |

20 | |

| Total | 330 |

||

The above-mentioned current plan may be reviewed and changed in actual investment decisions and their implementation depending on conditions of business opportunities, such as progress and timing of projects.

Financial targets

For fiscal 2025, the final year of the Plan, the Company aims to achieve 850 billion yen in net sales and 50 billion yen in operating income with an EBITDA of 110 billion yen and an ROE of 5 percent.

- While the Company plans to sell strategic shareholdings, including cross-shareholdings, worth approximately 40 billion yen during the period of the Plan, the impact of the share disposal is not taken into account in the financial targets above.

Policy of rewarding shareholders

We will distribute profit to our shareholders with a target total return ratio of 80 percent during the period of the Plan.

Investing in future growth opportunities while providing a sufficient return to shareholders

We will distribute profit to our shareholders with a target total return ratio of 80 percent during the period of the Mid-Term Management Plan 2025.

Dividend

Aim for a payout ratio of 50 percent or higher on a consolidated basis

Set a minimum annual dividend of 46 yen per share and gradually increase the amount

Share repurchase

Implement share repurchase in an agile manner

- The extraordinary income and losses arising from the disposal of assets are not taken into account, in principle, when we calculate the total return ratio and the consolidated payout ratio.