Capital Efficiency Initiative 2027

Capital Efficiency Initiative 2027

We will advance our growth strategy and capital and financial strategy in tandem, aiming to achieve an ROE of 8% or more in fiscal 2027.

2025

Medium-Term Management Plan 2025

Management issues and

Mid- to long-term management goals

To achieve

Action Plan

[KPI]

- ROE: 5.0%

- Sales: 850 billion yen Operating profit: 50 billion yen

- EBITDA: 110 billion yen

[Three major challenges]

- Seeking continuous growth in existing business domains

- Exploring, commercializing and monetizing new growth opportunities

- Enhancing management foundation to support growth

2027

Capital Efficiency

Initiative 2027

Capital costs and

Stock price conscious

To realize management

Initiatives aimed at

[KPI]

- ROE: 8.0% or more

- Operating profit: 65 billion yen

- EBITDA: 120 billion yen

- Net profit: 48 billion yen

- Equity capital: 600 billion yen

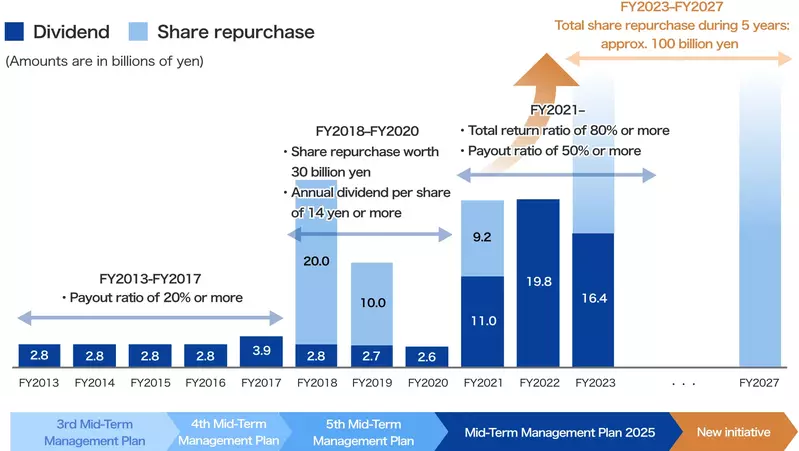

- Share buybacks: Cumulative total of approximately 100 billion yen over five fiscal years

[Initiative Policy]

- Growth Strategy

- Business portfolio optimization

- Capital and Financial Strategy

- Improved asset efficiency

2030

Mid- to Long-Term Management Goals 2030

Long-term management vision

Towards realization

Quantitative/qualitative goals

[Economic value]

- Sales: 1 trillion yen

- Operating profit: 80 billion yen

[Social and environmental value]

- Contributing to the environment through Eco Action Plan 2030

- Building a sustainable value chain

- Creating a business environment where diverse human resources can grow and thrive

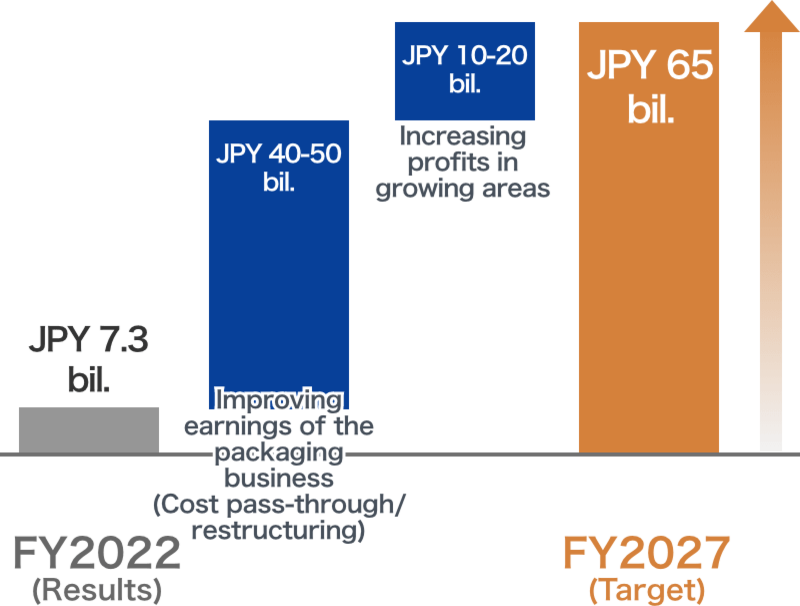

Measures to achieve ROE of 8% or more

We aim to achieve an ROE of 8% or more by increasing profits (R) and reducing equity capital (E).

Improvement in R: Operating profit (FY2023-FY2027)

By optimizing the business portfolio

Aiming for operating profit of 65 billion yen

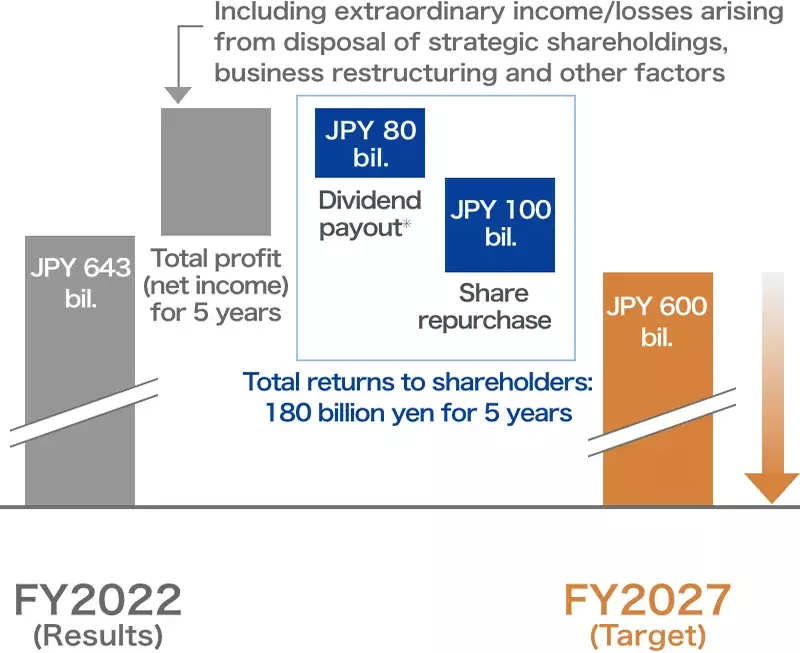

Compression of E: Equity capital (cumulative total for fiscal years 2023 to 2027)

Strengthening shareholder returns, etc.

Aiming for equity capital of 600 billion yen

- Dividends for fiscal years 2026-2027 are estimated as an extension of the fiscal year 2025 level, but will be determined based on actual profits and taking into account our dividend policy.

Growth Strategy

Business portfolio optimization

- Investing management resources in growth areas such as Engineering, Filling and Logistics Businesses, Steel Plate Related Business, and Functional Material Related Business

- Appropriately pass on sales prices, primarily in the domestic Packaging Business, and restructure unprofitable business areas and bases

- The table can be scrolled left and right

| Unit: 100 million yen | FY2022 | FY2023-FY2025 | FY2026-FY2027 | FY2027 target |

|---|---|---|---|---|

| PackagingRestructuring | Sales: 5,444 Operating profit: -107 Operating profit margin: -2.0% |

Selling price pass-on (30 to 35 billion yen)

|

Sales: 6,000 Operating profit: 300 (+407) Operating profit margin: 5.0% |

|

|

Unprofitable business areas

Reconstruction of bases |

||||

|

Cost reduction through environmental friendliness, automation, and labor saving

|

||||

| Engineering/Filling/Logistics Growth (partial restructuring) |

Sales: 1,983 Operating profit: 87 Operating profit margin: 4.4% |

Unprofitable business areas

Reconstruction of bases |

Sales: 1,900 Operating profit: 130 (+43) Operating profit margin: 6.8% |

|

|

Improving profitability against the backdrop of the expansion of the global can manufacturing equipment market (Engineering)

Increasing production capacity (filling) in Asia where demand is expected to increase |

||||

| Steel PlateGrowth | Sales: 865 Operating profit: 46 Operating profit margin: 5.4% |

Growth measures through capital investment in automotive secondary battery materials, which are experiencing significant growth

|

Sales: 1,100 Operating profit: 70 (+24) Operating profit margin: 6.4% |

|

| Functional MaterialsGrowth | Sales: 457 Operating profit: 20 Operating profit margin: 4.4% |

Growth strategy through business expansion utilizing proprietary technologies such as optical films

|

Sales: 600 Operating profit: 60 (+40) Operating profit margin: 10.0% |

|

| Cross-segment Growth Areas Growth |

Further expansion of materials and engineering in the mobility market

|

Sales: 800 Operating profit: 60 (+60) |

||

|

Filling and packaging containers for growing markets, mainly in Southeast Asia

Growth measures utilizing M&A to expand business areas |

||||

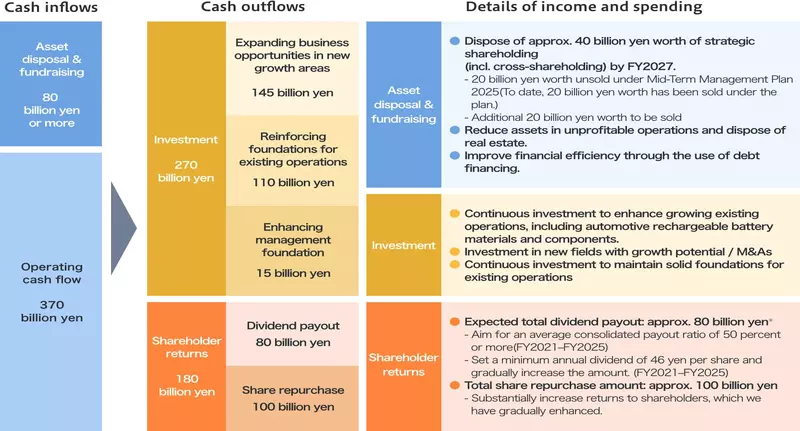

Capital and Financial Strategy

Improved asset efficiency

- Significantly strengthen shareholder returns through gradually expanding dividends and share buybacks

- Further reduction of cross-shareholdings

- Reduce assets in unprofitable business areas and sell and increase the value of real estate

- The table can be scrolled left and right

Cash Allocation (FY2023-FY2027)

We aim to grow our business and improve return on capital by strategically allocating funds from operating cash flow and asset sales and fund raising to investments and shareholder returns.

- The table can be scrolled left and right

- Dividends for fiscal years 2026-2027 are estimated as an extension of the fiscal year 2025 level, but will be determined based on actual profits and taking into account our dividend policy.

Financial Targets

Aiming to further improve return on capital, we have set new profit and equity targets for fiscal 2027.

- The table can be scrolled left and right

| This announcement | |||||

|---|---|---|---|---|---|

| FY2022 results | FY2025 | FY2027 | FY2030 | ||

| Earnings | Sales | 906 billion yen | 850 billion yen *1 | - (Reference: Approximately 1,050 billion yen) |

1,000 billion yen *1 |

| Operating profit | 7.3 billion yen | 50 billion yen | 65 billion yen | 80 billion yen | |

| EBITDA | 60.3 billion yen | 110 billion yen | 120 billion yen | - | |

| Net profit | 10.3 billion yen | 35 billion yen | 48 billion yen | ||

| Returns on capital | ROE | 1.6% | 5.0% | 8.0% or more | |

| Equity capital (new target) | 643 billion yen | - | 600 billion yen | ||

| FY2022 results | FY2021-2025 | FY2023-2027 | |||

| Shareholder returns | Consolidated dividend payout ratio (Dividend per share) |

156% (89 yen) |

Aim for 50% or more (Lower limit: 46 yen, (Increase gradually) |

Same as left In five years Estimated to be approximately 80 billion yen*2 |

|

| Total return ratio (Treasury stock acquisition) |

156% (0 billion yen) |

Aim for 80% or more (9.2 billion yen already implemented) |

In five years Approximately 100 billion yen |

||

- As the current increase in sales is due in part to the impact of exchange rate fluctuations and the pass-on of rising energy prices to sales prices, the sales targets for fiscal 2025 and fiscal 2030 have been left unchanged.

- Dividends for fiscal years 2026-2027 are estimated as an extension of the fiscal year 2025 level, but will be determined based on actual profits and taking into account our dividend policy.